(c) 2007, Andrea M. Hill

Mr. Bumble's Basketball

A hungry heart is the primary requirement for entrepreneurial success, and too-ready financing can take away the drive, the fear, and the anxiety that lies behind most business success.

Originally Published: 08 September 2007

Last Updated: 30 October 2020

Andrea Hill's Latest Book

Straight Talk

The No-Nonsense Guide to Strategic AI Adoption

Where other books focus on prompts and tools, this book gives business leaders what they actually need: the frameworks and confidence to lead AI adoption responsibly, without having to become technologists themselves.

Also available at independent booksellers and libraries.

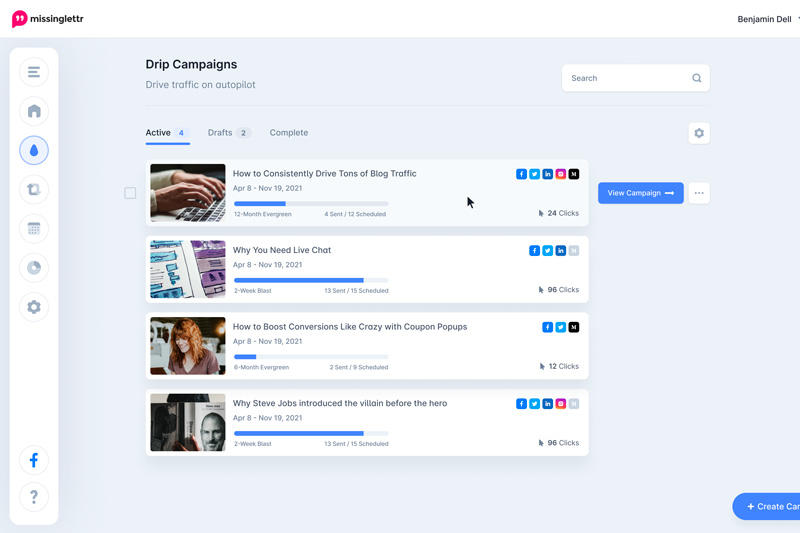

Software & Service Links

The links below are for services offered by Andrea Hill's companies (StrategyWerx, Werx.Marketing, MentorWerx, ProsperWerx), or for affiliate offers for which we may receive a commission or goods for referrals. We only offer recommendations for programs and services we truly believe in at the WeRx Brands. If we're recommending it, we're using it.

Mr. Bumble has a blank check. He's the most dangerous sort of entrepreneur, high on ideas and low on execution, but able to continue because he has financing. The opportunity that will make him a very rich man is always just on the other side of the visible horizon. So he pursues his dream with . . . abandon? No, not really. More like a day-tripper enjoying the sights.

But behind the starched shirt and the spiffy tie lies an unfortunate reality. Mr. Bumble does not have a hungry heart. A hungry heart is the primary requirement for entrepreneurial success, and too-ready financing can take away the drive, the fear, and the anxiety that lies behind most business success.

We saw this happen in the late 90s with all the Dot/Coms, leading up to the inevitable burst bubble. Baby entrepreneurs were handed blank checks by a private capital market that was swimming (and generally, still is) in excess capital. The act of vesting all that money in formative businesses had the effect of making them feel like they had arrived already, dulling the competitive drive necessary to achieve real financial success. But those Dot/Coms all talked so competitively, you say. In between bouts of pinball in the cafeteria while eating free meals, they talked about how they would slam dunk their competition and dominate the market, didn't they? Perhaps. But the competitive instincts of a middle school wing forward at a Tuesday night game are very different than the competitive instincts of a prairie homesteader determined to keep a wolf from his one winter pig.

We see this happen regularly in family business, when the company that was scraped together by grandma and grandpa is now being tended by grandchildren who have never known what it was like to go without the latest electronic gadget, let alone a meal. A recent study by Grubman and Jaffe (2007) demonstrated that those who have to acquire wealth from scratch view risk as a desirable pursuit - the hurdle they must cross to get from nothing to success. In contrast, those born to wealth view risk as something to be avoided - the gamble that could create a downward transition in their economic reality. As they state in the study, "Growing up with financial security tends to reduce risk tolerance and favor conservatism, since risk is known less as opportunity and more as crisis" (p. 156).

There are benefits to both viewpoints. If you have a large, established business with fantastic margins in a mature industry, risk-averse may be the way to go. Protect your assets, accept low growth, and carefully watch your flanks. Anyone familiar with business case studies knows that there is still a lot of risk involved in this approach, but it's doable.

However, if you are a small contender in your market, and growth is your only option to achieve prosperity, how hungry is your heart? If you can't tolerate going to bed at night with a flutter of anxiety, if you can't stand the idea of working 80 hours a week and still feeling like you haven't done enough, if you can't tolerate the idea of being unsuccessful with this venture, there are other career options for you that would be better than this one. You could buy a franchise. I'd suggest Chik-fil-A if you can get past the screening process. Or you could go work for the government, the last stronghold of the dependable pension.

Most of the people reading this ongoing reflection on business have indicated that you are entrepreneurs. So my challenge to you today is to reflect on your relationship with risk. Whether you want a business that will give you a comfortable income for the next 20 years, whether you want to build your business into something whose sale will give you a comfortable retirement, or whether you want to be the next Richard Branson, the heart is still the same. Put down your basketball, pick up your rifle, and go get that wolf out of your pigpen.

Reference:

Grubman, J., & Jaffe, D. (2007). Immigrants and natives to wealth: Understanding clients based on their wealth origins. Journal of Financial Planning, 20, 54-60.