Buying or making one product and selling it at a good margin does not a business make. Well, that’s not entirely true. If you’re George Steinbrenner and you can sell the Yankees for $1.5 billion after buying it for $10 million – even if it was some 35 years ago – that’s not a bad deal. But for the rest of us mere mortals who don’t live on the back pages of the tabloids, velocity, multipliers and marginal utilities matter.

The rate at which cash moves through the system is called “throughput,” and it’s the single biggest driver for business profitability and cash flow (Goldratt, 1990). Evoking Ram Charan in my posting yesterday got me thinking about his favorite example. As I mentioned, he compares Harvard MBAs to third world street vendors and finds the MBAs lacking. In the example he uses, he describes how a street vendor intuitively knows not just how much they buy and sell their goods for, but how many times they must buy and sell those goods, and at what margins, to generate enough cash to feed their families.

The average uneducated third world street vendor can rapidly calculate not only the margin, but the velocity needed, to be a sufficiently profitable business. If they can buy and sell 10 baskets of apples 3 times per week and sell them at a 10% profit, they net $3.00. But if they can buy and sell 10 baskets of apples 7 times per week at a 5% profit, they net $3.50. That’s nearly a 17% increase over their higher margin “opportunity.”

OK, most Harvard grads understand this point. But what a lot of business people don’t get is the next idea, which doesn’t seem to elude third world street vendors one bit.

You see, the apple seller realizes that they can keep selling apples at the velocities and margins described above – after all, people always need apples. But say they recognize that what is really in demand a few times each year are oranges. The apple seller doesn’t have the capital to sell both oranges and apples. But the opportunity is in oranges, and even though the apple seller is called “The Apple Seller,” which is a pretty significant personal identity connection to one’s business, do they stick to apples out of emotion or devotion? Heck no. They have to face their hungry children at night. They switch to oranges (or Nike tennis shoes, or batteries, or chicken jerky) because the opportunity is better there and they recognize they do not have enough resources to invest in weaker opportunities when stronger opportunities are present.

This is the part the MBA students (and most owners of business) don’t get. It comes from marginalist theory, and it says that in an economy, the marginal utility of a quantity is related to the best good or service that can be purchased with available currency. Of course, if you have unlimited resources, it doesn’t matter, does it? You can splurge your resources on limited profitability and limited velocity (which is more often the culprit) goods because you have more than enough currency to invest in the rest of your business.

But as I said at the beginning of the article, back to the rest of us mere mortals. Say we have a good (or, in my case, a service) that we love to sell. It suits our identity, our personality, and it’s fun for us. We love it, so why wouldn’t everyone else? And besides, we make some money on it. And all profit dollars are the same, right? Wrong! Wrong wrong wrong wrong wrong! We don’t have unlimited resources. To be successful businesspeople we must honor the marginal utility of our currency and only invest our dollars in the items that will provide the sheer throughput to generate more wealth.

When we are George Steinbrenner and have, perhaps not as much money as Bill Gates, but way more than enough to never worry about money again, we can invest in personal pleasures and pretend it’s business. But barring that level of liquidity and comfort, only constant attention to velocity and marginal utility will allow us to sleep well at night.

*Goldratt, E. M. (1990). What is this thing called theory of constraints and how should it be implemented? Croton-on-Hudson, NY: North River Press.

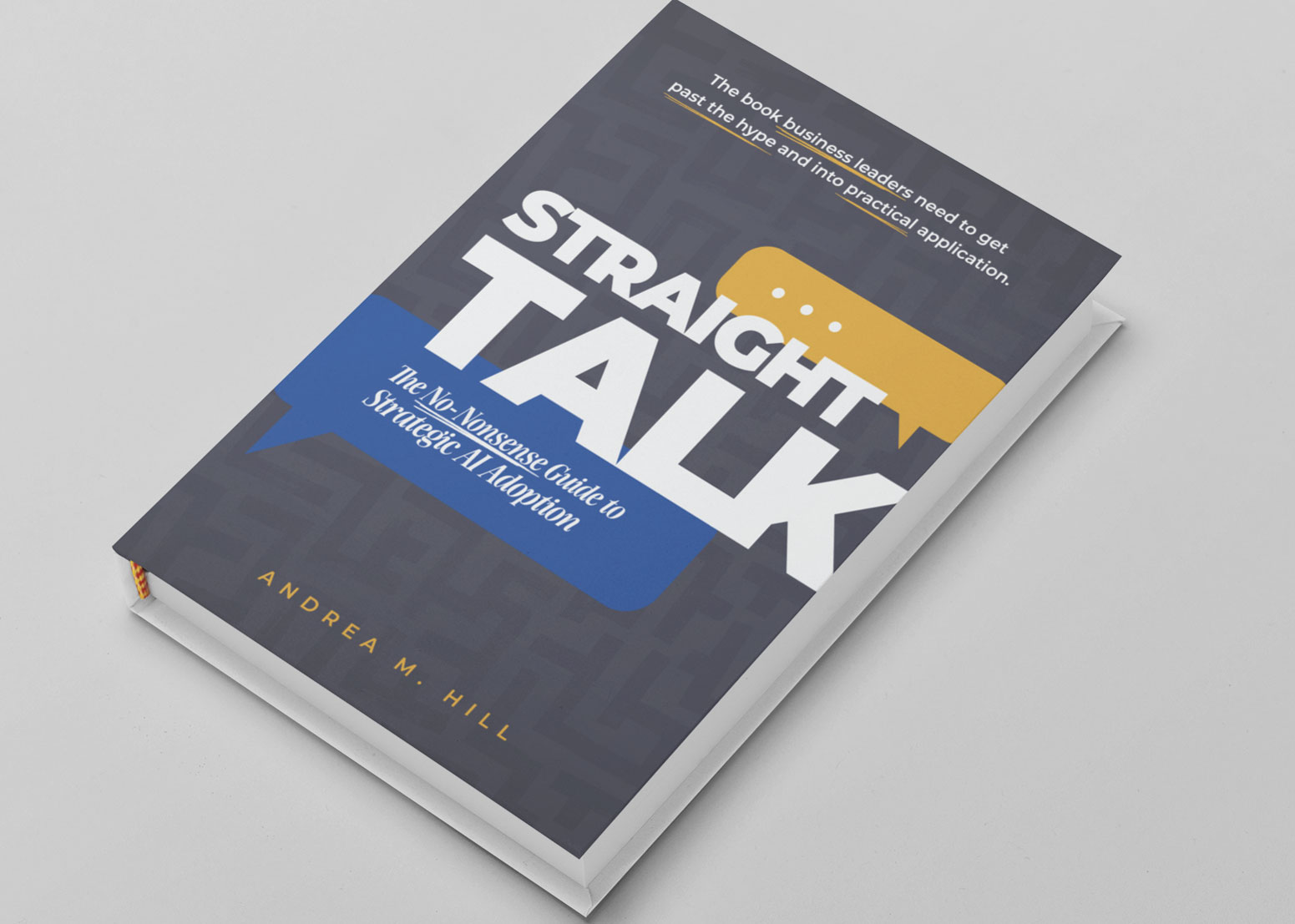

© Andrea M. Hill, 2007