As the jewelry industry heads into its biggest American show of the year, designers are questioning the best way to price their lines. What follows is a reflection on some important considerations when establishing a pricing strategy for a designer jewelry label.

Designer and brand jewelry lines must be very careful to avoid commoditization. Whereas non-differentiated manufacturing concerns price based on the current precious metal market, to do so as a brand or designer will reduce the design aspect of the jewelry to the equivalent of ‘labor’, which can only precipitate a race to the bottom. This is tantamount to saying that two paintings that required 22 hours, oil paints, and 17 brushes to produce hold the same value, though one was painted by Gustav Klimt and the other by a technically competent reproducer of others’ original works.

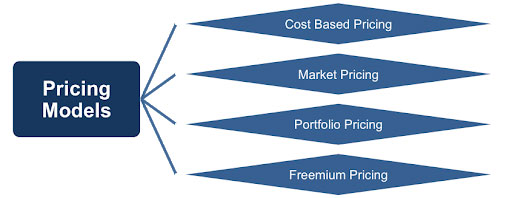

Designer and brand jewelry executives must consider a number of concerns – some of them conflicting – when establishing pricing strategy. This topic can hardly be covered in the space of a blog, but I will address the high points in the hopes of launching a meaningful discussion within the jewelry design community.

On Avoiding Commoditization

The only defense against price competition is differentiation. Though it is difficult to differentiate on design – and I strongly encourage designers to include elements of differentiation in addition to design – differentiate you must. Let Cindy Edelstein’s be the voice in your head on this point: Cindy preaches that all the designers in an aisle at a tradeshow should be able to commingle their jewelry in the aisle, and she should be able to tell from design characteristics alone to which designer each item belongs. Without a distinctive voice the buyer will ultimately force you to differentiate on price because you will have given them nothing else to work with.

At the risk of seeming like I am downplaying the difficulty of finding good retail accounts, remember that you don’t need all the customers, you need the right customers. A retailer who only focuses on the price of your product based on the metal and gemstone content is not an ideal target. If he can’t see the design value for himself, what is the likelihood he has trained store staff to see and sell design to jewelry consumers? But once you are pulled into the retailer’s non-design-focused pricing strategy, it is nearly impossible to charge the right price when you encounter the right sort of retailer. You will do better working your tail off to find designer-focused retailers than to try to convince generic jewelry retailers to pay the right price. Sound difficult? It most certainly is. But that is the challenge of going into a designer business. If you had decided to be a high-volume producing manufacturing business, your big need would be the capital to invest in the production techniques and technologies necessary to produce in volume. The challenge for a designer business is the creative strategy, brand identity, intensive marketing research and analysis, promotion, and sales activities necessary to find the right customers.

On Variable Costs

You must know your variable costs to protect your margins. Variable costs include the raw materials and labor to produce each piece. Obviously, the first time you produce an item will take longer than subsequent production efforts, so you want base the labor on standard production. Estimating variable costs is, well, a big no-no. If your estimates are off and you negotiate a large order at the wrong price, you may run completely out of cash before you discover your error. Know your exact variable costs.

Metals are the big worry right now. Should you price gold at a $1300 market or $1500? Everyone has heard a horror story of $2000 or worse. Here are a few thoughts to consider when deciding what market to base your pricing strategy on:

- Investment demand for gold continues to hold at fairly high levels, bolstered by concerns about inflation and investor worries about the European economy. On 5/17/10 Kitco projected that gold could go up to $1700 this year, and most forecasts are eyeing the $1350 - $1500 range.

- Johnson Matthey is projecting platinum prices in the $1600 - $2000 range for the balance of the year.

- Silver has been experiencing market resistance in the $19 range, but if it manages to break through that resistance it could track up sharply and take many people by surprise.

- You must be aware of how other designers are pricing their lines. If you are at an $1800 gold market and everyone else is at $1300, you’ll likely be priced out of the market. Watch Cindy Edelstein’s blog this week for her report regarding current designer market bets.

Some will argue that it is better to be safe than sorry, and will price their lines at a specific market and tell retailers that orders will ship at the actual metal market the day of shipment. This may be fine for commodity-level manufacturers and distributors, but I advise against it for designers. As I said before, once you train the retailer to think about your line as a commodity + labor offering, you have thrown your design value out the window. I recommend a harder – but ultimately more sustainable – road for brands and designer lines.

Pricing for Margin and Value

So what’s a non-financial-analyst designer to do? Start by considering what price your target consumer is willing to pay for your line, and what margin your target (i.e., ideal) retailer wants to get. This involves market research. Trade shows are a terrible place to do consumer market research, because you can’t assume your competitors have done their consumer research. Pay attention to what your competitors are doing, but don’t fool yourself into thinking this is a replacement for consumer awareness. Listen to actual consumers, study what they are buying, find comparable items to your designer line, and learn what consumers are willing to support with their debit cards. This is where the real value of social media exists by the way. At any given moment hundreds of thousands of conversations are taking place, and many of those people are talking about what they buy, how much they spent, and where they bought it. These conversations are yours for the eavesdropping. Learn to listen in and you’ll begin to understand what consumers really think.

Once you have a sense of what consumers are willing to pay for jewelry like yours, subtract the target margin of the retailer. Now cost your line at a $1350, $1500, and $1700 gold market. Answer the following questions:

- Can you meet your financial obligations and generate organic cash flow to cover your growth requirements at each of those margins?

- If the answer to #1 is ‘no’, do you have outside financing available (already committed) to you?

- If the answer to #2 is ‘no’, how will you fund the metal purchases, labor, and operational costs necessary to keep filling orders?

To generate organic cash flow, you must have margin. If you give up significant margin, you must generate so much additional volume that you can produce the number of dollars necessary to fund growth. If you can’t support the demand operationally once you get those additional orders – or if the number of dollars you need remains persistently out of reach - you’re out of business. Landing a few choice accounts won’t keep you in business. The key to remaining in business is producing more dollars. So giving up margin to snag a few choice accounts is rarely the road to success.

Look, if you’re going to put yourself out of business anyway, it’s probably worth your time and effort to get on the phone and call every retailer in the country yourself, just to find the 15 or 20 retailers who get it about designer jewelry and understand that it is not a commodity. There are more than 20,000 retail doors in this country, and most of them (sadly) are treating jewelry as a commodity these days. But not all.

Enlightened retailers exist. There are (dare I say it) more than 15 or 20 of them. There are at least several hundred retailers who understand that the key to turning consumers on about jewelry is being turned on about jewelry themselves, and training their sales and purchasing staff to be turned on about jewelry. They are using this advantage (yes, differentiation) to put their retail competition out of business, and because they understand love-of-margin, they are charging the right prices and doing the hard work necessary to find the right customers and encourage those customers to pay those prices.

Does this mean that when you find those retailers you will automatically solve your price problems? No, it doesn’t. You still must have tremendous control over your production, you need to know – not estimate – your variable costs, and you need to do everything in your control to keep your costs down so you can enjoy healthy margins after some reasonable negotiation with your retail partners.

You already know being in business for yourself is hard work. But working this hard for no money? That’s just not worth it. So don’t take your need for margin off the table. Differentiate. Do your variable cost homework. Do your consumer research. Price according to consumer demand and make sure you turn a profit. Strategize, brand, market, promote. Find the right retail partners. Sell your intrinsic value and differentiation (not your materials + labor!).

Make some money. You’re worth it.

(c) 2010. Andrea M. Hill